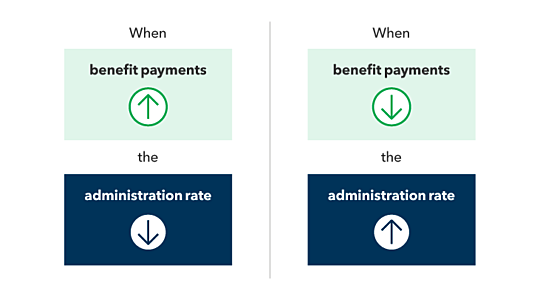

At the beginning of each year, we set a provisional administration rate for Schedule 2 organizations, which we use to determine your monthly administration charges for that year.

When we complete our year-end financials, we look at actual experience over the year and then determine what your actual administration rate should have been. At that time, we will either credit or charge you the difference between the provisional and actual rates as a one-time adjustment.

This rate reflects the allocation of COVID-19 costs across Schedule 2 businesses, since the WSIB reimbursed businesses for costs related to COVID-19 claims in 2021.

For 2021, because the administration expenses were lower than projected, we will provide Schedule 2 organizations with a credit.

See the tables for details about the 2021 administration rate adjustment.

If you have any questions about this update, please contact your Schedule 2 Account Service Representative or the Schedule 2 general revenue enquiry number at 416-344-3646 or toll-free at 1-800-387-0750.

- 2021 actual administration rate for provincially regulated organizations

- 2021 actual administration rate for federally regulated organizations

- 2021 actual administration rate for organizations covered under the Government Employees Compensation Act

2021 actual administration rate for provincially regulated organizations

Your 2021 actual administration rate decreased to 23.57 per cent from the provisional rate of 24.6 per cent. As a result, you will receive a one-time credit adjustment.